Are you trying to determine your level of financial satisfaction or dissatisfaction? After all, if you’re more satisfied financially, you should also be happier and less stressed. Good news! The FS Wealth Reality Ratio (FSWRR) will help you quantify your feelings and reveal the unhappiest cities in America!

The core attribute about the FS Wealth Reality Ratio is about managing expectations. After all, happiness equals reality minus expectations. The higher your expectations, the lower your happiness. The better the reality compared to expectations, the higher your happiness.

If you go to Harvard and end up doing the exact same work as a non-Harvard graduate does, you might feel a little disappointed. But if you go to Podunk U and end up getting paid the same as your Harvard co-worker, you are probably thrilled!

I didn’t go to Podunk U, but I did go to The College of William & Mary for only $2,800 a year in tuition from 1995 – 1999. Comparable private universities cost about $22,000 a year at the time.

Therefore, any job I got that paid more than my $4/hour McDonald’s job in high school would be a blessing. And boy did it feel good not to have high expectations placed upon my shoulders.

The Financial Samurai Wealth Reality Ratio (FSWRR)

As a Financial Samurai, always think in derivatives. Try to think about what’s behind and beyond the numbers. When you start thinking in derivatives, you will find many more answers and solutions to common problems.

In my article about the net worth amount required to be considered wealthy in various cities, I introduced you to the Financial Samurai Wealth Reality Ratio (FSWRR). The higher the ratio, the unhappier you likely are and vice versa. Below is the ratio’s formula.

FSWRR = Minimum Net Worth Required To Be Considered Wealthy / Median Home Price

For example, if you believe you need a net worth of $50 million to be happy in a city that has a median home price of only $500,000, psychologically there’s likely something wrong with you.

A 100:1 FS Wealth Reality Ratio is extreme. Your expectations about how much happiness money can bring you is way too high. Further, you’ll likely never going to achieve that level of net worth.

Source Of The Data

The data about the minimum net worth required to be considered wealthy comes from Charles Schwab’s annual Modern Wealth Survey. Your individual opinion matters. However, having a larger survey is more impactful for statistical significance and overall research purposes.

The median home price comes from Zillow, Redfin, St. Louis Fed, US Department of Housing And Development, and the National Association Of Realtors. These figures are more objective. Although interestingly, nobody really can say with certainty what the median home price is in America.

By analyzing mass data, we can identify which city residents are happiest (most satisfied) and unhappiest (least satisfied).

Why The Median Home Price Is Used

The median home price is used in the denominator because it is a reflection of the cost of living in your city and its resident’s earning potential. The median home price also reflects the cost of local goods and services, economic environment, and desirability of your city.

The reason why the median home price in Hawaii was ~$890,000 in 2022 is because Hawaii is heaven on Earth. In contrast, West Virginia’s median home price was only ~$135,675 in 2022 mainly because there is less economic opportunity. Hawaii is an international tourist attraction while West Virginia is not.

Another reason why I use the median home price of your city in the ratio is because of the importance of housing. Once you have your housing costs relatively fixed, living the life you want usually becomes much easier. After all, the housing expenditure is usually the largest necessity expense, followed by food, clothing, and transportation.

Stabilizing your housing costs is why I highly recommend everyone get neutral property by owning their primary residence as soon as you know where you want to be living for at least five years. Riding the inflation wave is much better than getting pounded by it.

With housing security for your children, you also won’t feel as much anxiety. And one of the best reasons to have money is to worry less about money and survival.

The Higher The FS Wealth Reality Ratio The Unhappier You Are

The reason why the higher the Financial Samurai Wealth Reality Ratio, the unhappier you are is due to expectations. Schwab’s Modern Wealth Survey is based on what people THINK is the minimum net worth required to feel wealthy in their respective cities. The survey is not based on what people already have.

We know this to be the case because not everybody surveyed in San Francisco in 2022 has a net worth of $5.1 million, a top 2% net worth (top 1% net worth is over $11 million). The participants collectively think $5.1 million is what is needed to feel wealthy. One report by the Legislative Analyst’s Office in 2019 had the the average net worth per resident in San Francisco at $450,000.

If you have a Wealth Reality Ratio of 8, that means you believe you need a net worth 8X greater than the median home price in your city to feel wealthy. Cleary, trying to build more wealth will take longer and be more difficult than trying to build less wealth.

Therefore, you will feel more stressed, tired, anxious, and demoralized the longer you have to work and take risks to achieve what you think you’ll need to feel wealthy.

Conversely, if your Wealth Reality Ratio is only a 3, then you feel you only need a net worth 3X greater than the median home price of your city to feel wealthy. Thanks to your lower expectations, you don’t have to work as long and take as many risks to get to your aspirational wealth number. You can FIRE if you want to because you’re more easily satisfied with what you have.

The Unhappiest Cities In America By Wealth Reality Ratio

Based on the logic that a higher Wealth Reality Ratio means more struggle and less happiness, below are the latest 12 cities ranked from most satisfied financially to least satisfied financially.

Some thoughts and possibilities based on the ranking:

- Cities with higher median home prices tend to have more financially satisfied residents.

- Coastal city residents are more financially happy than non-coastal city residents.

- There is likely more wealth inequality in Houston and Dallas between the very rich and the middle class perhaps due to the oil industry.

- LA / San Diego may have the best combination of financial satisfaction with upward mobility, great weather, and a nice lifestyle.

- Move to Houston, Dallas, Chicago, or Atlanta for retirement if you already have a $2+ million net worth given the low cost of living.

- Boston residents are some of the most financially satisfied residents despite high home prices. But I don’t know why given the weather is rough for a third of the year and the Warriors won the 2022 NBA final.

- High property taxes might be a big variable for why Houston, Dallas, and Chicago have the least financially satisfied people.

- San Francisco and Seattle have the highest wealth-creation potential, which is also partly why their residents are the most financially happy.

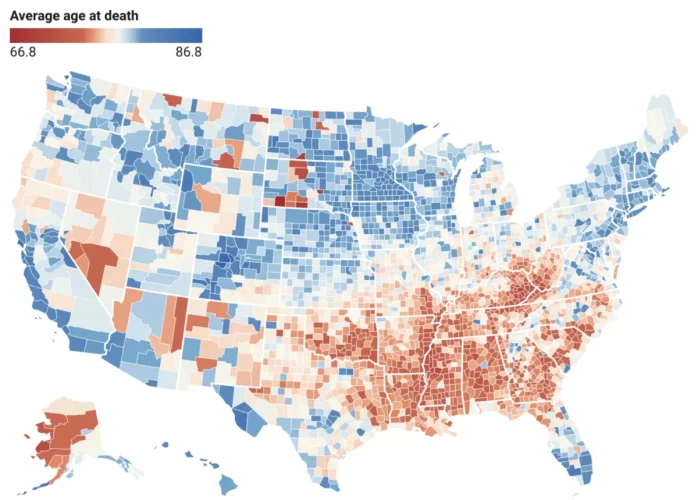

- There is a correlation with cities with the highest satisfaction and states with the highest life expectancies. And given we all want to live longer, this is a huge breakthrough!

One important point to highlight is that happiness is also relative. Given America is the best country in the world with the most amount of opportunity, being ranked the unhappiest city in America is still likely better than most other cities in the world! It’s like only eating salmon filets at the buffet because they ran out of prime rib.

See: Why The Smartest Countries In The World Are Not The Happiest

More Examples Of Why A Higher Wealth Reality Ratio Is Worse For Happiness

There has been debate about whether a lower ratio signifies more happiness or not. Hence, let’s use more examples as to why a higher FSWRR number leads to decreased levels of happiness.

- It is more painful to run 20 miles than it is to run 3 miles and win the same medal. In this case, the medal is the denominator equal to the median price of a home.

- People are less happy if they must work for 40 years versus working 20 years before being able to retire to do what they love. In this case, retirement is the denominator given we all have a limited number of years to live.

- There is more heartbreak if it takes you 7 years to have a baby than 1 year. In this case, starting a family is the denominator and we all run out of time.

- You’re more frustrated if it takes you 10 years to write the next great personal finance book versus 2 years. In this case, being a published author is the denominator.

- The longer you live in your mom’s basement after high school or college, the more embarrassed you might feel. In this case, your pride is the denominator.

- The longer the airplane delay compared to the duration of your flight, the more agitated you are. A three-hour delay for a one-hour flight is brutal. However, a one-hour delay on a 12-hour international flight is no big deal. In this case, getting to where you want to go is the denominator.

Key Variable For Happiness

What’s the key variable in all these examples? It’s TIME!

The expenditure of time is also a key variable for my FS SEER ratio, which helps quantify your risk tolerance. The less time you are willing to spend to make up for your losses, the more conservative your investments.

Usually, the longer it takes for you to get what you want, the less happy you are. Due to a lack of discipline and patience, many folks prematurely give up before the going gets good. This giving up part and never reaching your goals is the biggest risk to happiness. The secret to your success is unwavering commitment and consistency!

However, for those of you who learn to appreciate the journey and who can survive a difficult path, the rewards are often much greater. We appreciate things more when we need to struggle hard to achieve them.

Therefore, the key to happiness is to have realistic expectations. Having too high expectations will lead to misery, since you’ll likely never achieve your goals. Having too low expectations will lead to indifference because you didn’t struggle hard or long enough.

Happiness, Wealth, and Life Expectancy

There is also a strong correlation with wealth and life expectancy. The richer you are, the longer you tend to live.

Notice how cities with the lowest FS Wealth Realty Ratio also are based in states with the highest life expectancies. Is that a coincidence? Of course not.Happiness and money are intertwined!

The richer and happier you are, the longer your life expectancy and vice versa.

The Ideal Wealth Reality Ratio

The lower your FSWRR the better, up to a point. This means your expectations for how much money you will need to be happy is lower. In return, your wants will be more easily satisfied.

Think back to when you were in high school or college. Although you were poor, you might have been much happier because so many things don’t require needing lots of money. I remember having $200 a month to spend in Beijing, China while studying abroad in 1997 and was thrilled to explore a new country!

However, the ratio likely can’t be much below 1X the value of the median home price in your city. This is because if your entire net worth is equal to the median home price, then you will need to continue working in order to generate income.

You can’t withdraw principal from your home without incurring debt. Nor do you have another net worth asset that you can use to generate passive income. If 100% of your net worth is tied up in the value of your home, you’re also at the mercy of the housing market.

At a FSWRR of 1X, you will need to survive off Social Security, rent out rooms in your house, or the generosity of others. Or you will need to own a home that is priced much lower than the median price for your city.

If you are lucky enough to have a pension, it may be worth much more than you think. The value of a pension while you are alive will most likely boost your FSWRR far above 1.

A Net Worth Equal To Two To Five Times The Median Home Price

It is my opinion the ideal wealth reality ratio is somewhere between 2 – 5. Let’s say your net worth is already there. Here are a couple examples that make sense.

At a FSWRR of 2, you could have a paid off home worth $400,000 and have $400,000 in investments generating $12,000 – $20,000 a year. Your total net worth is $800,000. In addition, you could also be collecting another $15,000 – $20,000 a year in Social Security and live a comfortable lifestyle.

At a FSWRR of 5, your net worth is $2,500,000 if the median price of a home in your city is $500,000. You could afford to rent a nice home for $50,000 a year if you wish. Your $2,500,000 net worth could generate $75,000 – $125,000 of passive income a year alone.

Personally, I’m a little more ambitious and greedy, which is why shooting for a FS Wealth Reality Ratio of 5 feels appropriate for me. After about a 5, I’m happy to start decumulating my wealth in order to not die with too much.

To get specific, if the median home price in San Francisco is $1.8 million in 2023, having a $9 million net worth is more or less good enough. And having a net worth of $5.4 million (FSWRR 3) is pretty good too.

How To Use The FS Wealth Reality Ratio For Your City

Let’s say you don’t live in one of the cities above. How can you use the FS Wealth Reality Ratio to help you ascertain how much net worth you should accumulate to feel wealthy?

Financial Samurai reader Mapuana asks,

Just curious if you have any idea how Hawaii fits into this? Having been raised there and left for several reasons, cost being one of them. I just wondered how it fit.

Step one is to find the median home price in Hawaii = $835,000 (Zillow estimate 2023). Then multiply by the multiple range of other comparable cities. The range is 3X – 10X for the 12 largest cities in America. Therefore, Hawaiian residents would need between $2,505,000 to $8,350,000 to feel wealthy.

However, given Hawaii is the best place on Earth, one could argue a multiple below 3 works. Hawaii weather is amazing. The beaches and mountains are free. Overall, Hawaiian residents live longer and are less stressed.

Therefore, I would say most Hawaiian residents need at most $2,505,000 to feel wealthy (FSWRR 3). But a Wealth Reality Ratio of 2 equaling $1,670,000 is probably plenty for most residents.

How To Use The FS Wealth Reality Ratio To Determine Your Financial Satisfaction

To quantify your financial feelings, come up with a minimum net worth you think is required to be wealthy and divide it by your city’s median home price.

Let’s say I’m delusional and think I need $50 million to feel wealthy even though I live in a $1 million house and spend less than $200,000 a year. My Wealth Reality Ratio would equal 50. I’m likely never going to be satisfied with my wealth.

Instead, I should probably shoot for a minimum net worth of between $5 – 10 million, a level many people believe is enough to have generational wealth. And if I already have a minimum net worth of between $5 – $10 million, then I need to learn to be more appreciative of what I have.

- 1 – 3 Wealth Reality Ratio means you are extremely satisfied financially.

- 3.1 – 5 Wealth Reality Ratio means you are satisfied financially.

- 5.1 – 10 Wealth Reality Ratio means you are slightly dissatisfied with your finances.

- 10.1 – 20 Wealth Reality Ratio between means you are dissatisfied with your finances.

- 20+ Wealth Reality Ratio means you are highly dissatisfied with your finances or are very money hungry

You May Want To Invest In The Unhappiest Cities

The unhappiest cities also have some of the highest cap rates and lowest valuations. These two factors along with positive demographic trends are why I’ve been investing in heartland real estate since 2016.

The Wealth Reality Ratio actually makes me even more bullish on investing in cities such as Houston and Dallas because it shows its residents are hungry for more wealth! And when you are hungry for more money, you will work hard to make more either at your job or by growing your business. More profits means more income and higher home prices.

The only problem now is rising supply and declining demand after an increase in mortgage rates. But trying to find single-family or multi-family deals in places like Houston and Dallas over the next 12 months seems attractive.

You can search for individual deals in Houston, Dallas, and other high Wealth Reality Ratio cities on various private real estate investment platforms. Or you can invest in a private fund that invests mainly in the Sunbelt through Fundrise.

The great thing about investing in private real estate is to invest anywhere without having to move. Further, you will earn income or distributions passively as you diversify your real estate holdings.

Keep Your Wealth Expectations Reasonable

When I graduated college, all I hoped for was a $30,000 a year job. When I got a $40,000 a year job at Goldman Sachs in 1999, I was thrilled! However, I soon found out that $40,000 didn’t go very far living in Manhattan. Hourly, I was making minimum wage. Therefore, I wanted more.

Every time I made more money, I was happier for about three months at most. Then it was back to my steady state of happiness. Finally, in 2012, I decided I had enough and retired.

Despite losing 80% of my income for the first year, I was happier because I was free. Being able to drive to the park and read a book instead of going in to the office at 6 am made up for my lost income.

When I left work in 2012, I was happy with my net worth. If I wasn’t, I would have kept on working. I expected my net worth to grow fairly conservatively, in the 4% – 5% range a year.

However, the subsequent 10-year bull run provided greater growth. This upside surprise has provided for greater happiness.

Keep Low Expectations For Your Endeavors Too

Today, I continue to try and keep my expectations measured.

For example, before starting to write Buy This, Not That in 2020, I told myself I just wanted to finish. The book was a bucket list item to help regular FS readers build more wealth and make my family proud.

It was hard enough juggling kids, Financial Samurai, and book writing during a pandemic. We had pulled our son from preschool for 18 months. Expecting BTNT to also be a bestseller would take away from my joy of writing.

However, once I finished writing the book in 2022 and received the advanced physical copies in my hand, my expectations went way up! It was a beautiful book that provides a wealth a knowledge.

Then I started thinking, why can’t this be an international bestseller? It rocks! The foreign rights in the Arab nations, China, Taiwan, Hong Kong, and Macau have already been negotiated.

As my expectations for my book increased, so did my anxiety! It’s hilarious how it’s so hard to keep our hopes and dreams contained. But we keep fighting because anything is possible!

In the end, Buy This, Not That became an instant Wall Street Journal bestseller. Hooray! But when is it going to get big in France?!

The Desire For More Money Needs To Be Carefully Measured

If I had a goal of retiring with $10 million when I was in my 20s or 30s, then I’d certainly be miserable due to the need to work for many more years. Instead, I left when my net worth was about $3 million.

$3 million could generate enough to provide for a basic lifestyle, not a lavish one in San Francisco. I knew what my upside was and decided it wasn’t worth it.

After you’ve got your basics covered, if you live in a developed country, your life is quite similar to much wealthier people. Sure, the super wealthy may have larger homes and fly in luxury all the time. However, the very rich revert to their steady state of happiness too.

I have one friend who is probably worth $200 million and makes $25 million a year. He flew first class to London ($20,000+) to go watch the Wimbledon tennis tournament. Front row tickets cost anywhere between $10,000 – $20,000 a day, depending on the round. I’m sure he’s having a lot of fun.

But I’m also having a lot of fun playing with my kids and watching Wimbledon on my relatively inexpensive 4K TV! Besides, flying is a PITA!

We should try to be more satisfied with what we have. Wanting less is the easy path to feeling wealthy. Always think about how much of your life energy is getting sucked away by spending time earning incrementally more money that you don’t need.

Ask yourself whether the marginal effort is worth it. If it’s not, then please have the courage to accept enough!

Reader Questions

Readers, what do you think about my Wealth Ratio? Can you argue how a higher Wealth Ratio is actually a reflection of happier people? What is your Wealth Ratio and do you agree with the various levels? Which cities are the unhappiest and happiest in your opinion?

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. To get my posts in your inbox as soon as they are published, sign up here.